Bigger Tax Breaks for Your Heavy Equipment Purchases

Get the heavy equipment you want, expand your business services, and take advantage of updated tax laws. Learn about the new expanded Section 179 Deduction + 100% Bonus Depreciation here.

Reach New Financial Peaks with Section 179 + 100% Bonus Depreciation

In July 2025, Congress passed—and the President signed—a federal law that permanently expanded key business tax incentives for companies making qualified heavy equipment and commercial vehicle purchases.

For eligible equipment purchases, these changes allow businesses to accelerate more depreciation into the first year, improving cash flow, freeing up capital for the next project, and potentially reducing overall tax liability. For companies in construction, paving, and other capital-intensive industries, these provisions can deliver immediate and measurable tax savings while supporting strategic growth.

Formally titled the Act to Provide for Reconciliation Pursuant to Title II of the House of Representatives Concurrent Resolution 14—and commonly referred to as the One Big Beautiful Bill Act (OBBBA)—this legislation was enacted through the budget reconciliation process and signed into law on July 4, 2025.

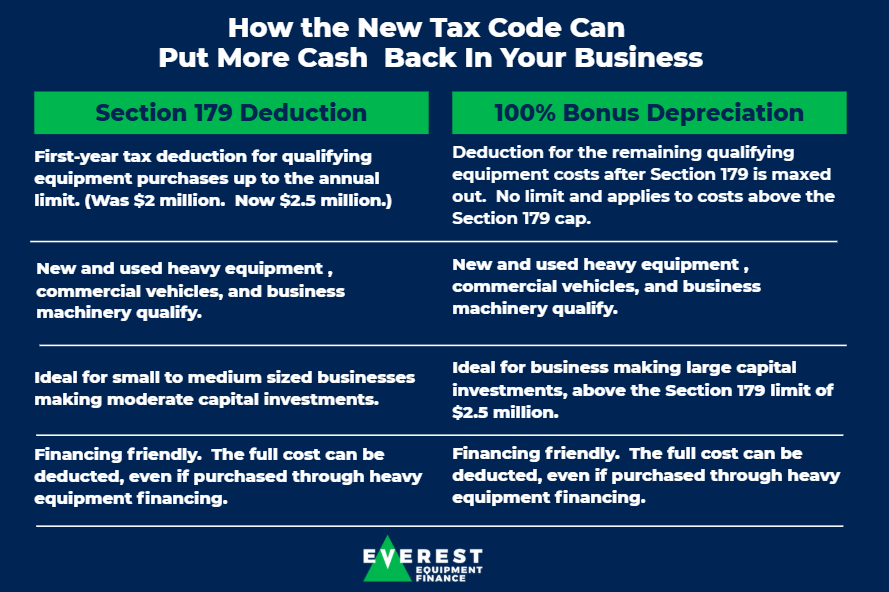

While the bill covered a broad range of government spending and revenue measures, two provisions are especially significant for businesses investing in equipment:

- Section 179 Deduction Expansion – Higher deduction limits and phase-out thresholds, allowing a larger portion of heavy equipment financing or purchase costs to be deducted in the first year.

- Permanent 100% Bonus Depreciation – Now available for qualifying purchases beyond Section 179 limits, enabling full first-year expensing on additional investments.

These provisions took effect immediately and apply to qualifying heavy equipment and commercial vehicles placed in service after January 19, 2025.

Section 179 Deduction

The Section 179 Deduction allows businesses to deduct the full purchase price of qualifying heavy equipment, commercial vehicles, and business machinery in the same tax year the asset is placed in service—rather than depreciating the cost over time.

This accelerated deduction strategy can provide immediate tax savings, strengthen cash flow, and free up capital for reinvestment in upcoming projects.

With the July 2025 federal tax law changes, the Section 179 limit increased to $2.5 million (up from $2.0 million), and the phase-out threshold now begins at $4 million in total annual equipment purchases.

For the 2025 tax year, these enhanced limits apply to qualifying assets placed into service after January 19, 2025.

Why this matters for business leaders:

- Enhances cash flow by reducing taxable income in the year of purchase

- Supports strategic growth for small and mid-sized companies making timely investments

- Applies to both new and used assets, including those acquired through heavy equipment financing

- Pairs with permanent 100% Bonus Depreciation—deduct beyond the Section 179 limits for even greater first-year benefits

100% Bonus Depreciation – Now Permanent

100% Bonus Depreciation allows businesses to immediately deduct the full cost of most qualifying assets in the same tax year they are placed in service—even after the Section 179 Deduction limit has been reached.

This expanded tax incentive applies to both new and used heavy equipment, commercial vehicles, and other business machinery, making it especially valuable for larger equipment purchases in construction, paving, and other capital-intensive industries.

Under the July 2025 federal tax law changes, 100% bonus depreciation is now a permanent part of the U.S. tax code.

For the 2025 tax year, it applies to qualifying assets placed into service after January 19, 2025, and works alongside the expanded Section 179 limits to maximize first-year tax savings.

Why this matters for business leaders:

- No spending cap—deduct all qualifying costs above the Section 179 threshold

- Accelerates tax savings for large-scale capital investments

- Applies to both new and used equipment, including assets acquired through heavy equipment financing

- Complement Section 179—use both together for complete first-year expensing on eligible purchases

Put the New Tax Code to Work for Your Business

Now is the perfect time to invest in your company’s growth. With Everest Equipment Finance, you can secure the financing you need to acquire the heavy equipment you need to move your business to new heights.

Our team can structure payments to match your cash flow and other business needs so you can purchase the right equipment to remain competitive in your market and keep your customers happy.

All while leveraging the expanded Section 179 Deduction plus permanent 100% Bonus Depreciation to maximize your tax savings and improve your financial position.

Example – Maximizing First-Year Deductions:

If your business makes an equipment purchase of $3 million in qualifying heavy equipment in 2025—or in any year going forward:

- Section 179 Deduction: Deduct the first $2.5 million immediately

- 100% Bonus Depreciation: Deduct the remaining $500,000 immediately

- Total First-Year Deduction: $3 million in potential tax savings.

How It Works:

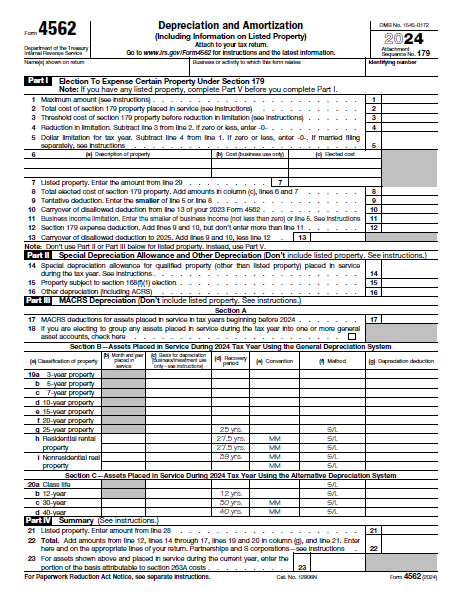

There is no separate government application for claiming the Section 179 Deduction or 100% Bonus Depreciation.

These benefits are claimed through your annual business tax return—typically using IRS Form 4562—with the guidance of your CPA or tax professional. Proper documentation of your equipment purchase and “placed in service” date ensures you receive the full benefit.

More Information

For more details regarding depreciation and amortization, and to download a copy of Form 4652 and instructions for completion of the form, please visit the IRS website About Form 4562 page.

Download a copy of Form 4562. Note that the 2025 version of the form is not yet available. This version is for 2024.

Disclaimer: The information provided here is for general informational purposes only and should not be construed as legal, accounting, or tax advice. Tax laws and regulations are subject to change, and their application can vary based on individual business circumstances. Before making any equipment purchase or financing decision, we strongly recommend consulting with your accountant, CPA, or qualified tax professional to determine how the expanded Section 179 Deduction and permanent 100% Bonus Depreciation may apply to your specific situation. Everest Equipment Finance does not provide tax or legal advice.