Equipment Financing

Solutions That Grow

Your Business

Secure competitive rates and flexible terms on equipment loans up to $2 million with approvals as fast as 24 hours.

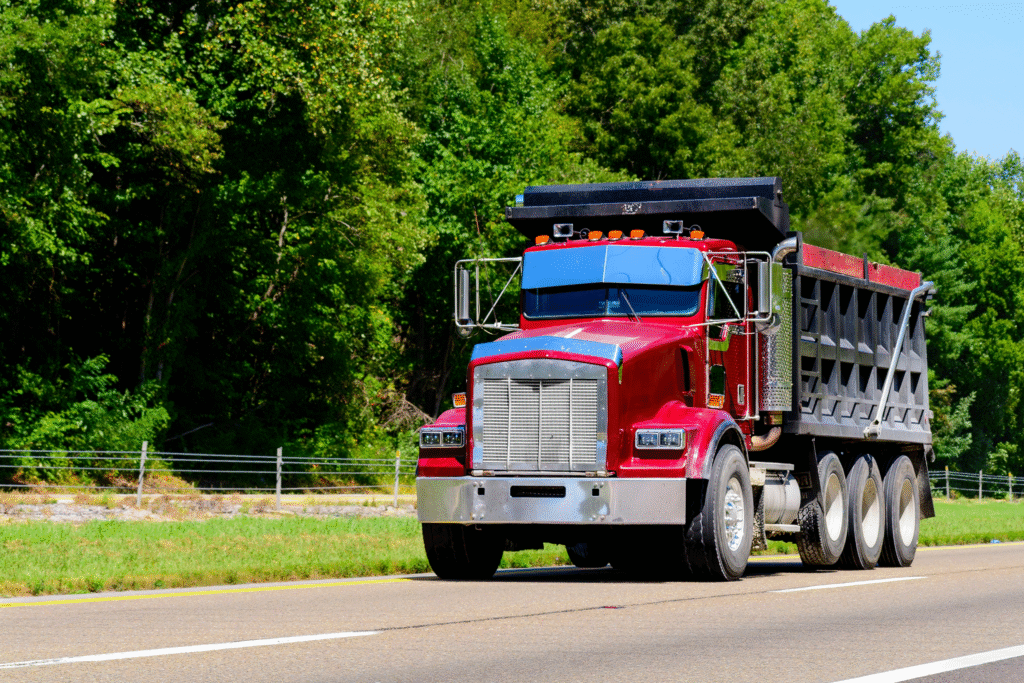

Heavy

Equipment

Financing

That Helps

Your Business

Grow

Protect cash flow and preserve

options while securing

equipment

you need to expand or upgrade

your business. With smart capital

solutions, fast approvals, and

flexible terms built around your

schedule, we're here to keep your

business moving forward.

Heavy Equipment Financing That Helps Your Business Grow

Protect cash flow and preserve options while securing equipment you need to expand your business. With smart capital solutions, fast approvals, and flexible terms built around your schedule, we can help keep your business moving forward.

Build More.

Haul More.

Spend Less Upfront.

At Everest Equipment Finance, we don’t just fund equipment—we fuel possibility. As a national lender with deep expertise across industries like construction, transportation, manufacturing, and telecommunications, we specialize in helping small and mid-sized businesses secure the heavy equipment they need to stay competitive, grow smarter, and keep moving.

We know that access to capital can be the difference between standing still and scaling up. That’s why we offer fast approvals, flexible structures, and financing solutions tailored to your operation—not some generic template. Whether you’re upgrading outdated machinery, expanding your fleet, or managing seasonal cash flow, our team structures each deal to support your unique objectives and long-term strategy.

Forget the red tape and rigid rules of traditional banks. We’re relationship-driven, consultative, and built to move at your pace—because in your world, timing is everything. With Everest, you get more than funding.

You get a partner who understands your business, shares your urgency, and is ready to help you reach the next peak.

Heavy Equipment Financing Solutions for Your Industry

At Everest Equipment Finance, we understand that every industry has unique demands—and that the right equipment is critical to getting the job done. That’s why we provide customized financing solutions for the sectors that keep America moving, building, and innovating.

Whether you’re hauling freight cross-country, clearing land for new development, or deploying technology infrastructure, our team brings deep industry knowledge and a relationship-driven approach to help you secure the equipment you need—quickly and confidently

“As CFO, I don’t just look for financing — I look for a partner we can rely on. Everest Equipment Finance has become exactly that. Their approach has helped us upgrade our waste and recycling vehicles every 3 to 5 years, keeping our fleet state-of-the-art and improving the services we provide to our customers.

Just as important, the financing structure helps us manage cash flow with greater efficiency and predictability. With Everest, we’ve found a partner built on trust, integrity, and shared success”

Michelle Milano-Emilio

Chief Financial Officer – Allegro Sanitation Corporation

“As CFO, I don’t just look for financing — I look for a partner we can rely on. Everest Equipment Finance has become exactly that. Their approach has helped us upgrade our waste and recycling vehicles every 3 to 5 years, keeping our fleet state-of-the-art and improving the services we provide to our customers.

Just as important, the financing structure helps us manage cash flow with greater efficiency and predictability. With Everest, we’ve found a partner built on trust, integrity, and shared success”

Michelle Milano-Emilio

Chief Financial Officer – Allegro Sanitation Corporation

Equipment Financing Helps You Reach New Heights

- Cash Flow Challenges During Off-Season

Seasonal businesses struggle with uneven cash flow throughout the year

- Seasonal Payment Options Available

Flexible payment schedules that align with your business cycles and revenue patterns

- Missing Out on Tax Advantages

Businesses need to maximize deductions before year-end deadlines

- Use Section 179 Deduction Before Year-End

Deduct the full purchase price of qualifying equipment in the year you buy it

- Growth Limited by Available Cash

Expanding your business shouldn’t drain your working capital reserves

- Monthly Payments Let You Grow Without Upfront Cost

Preserve cash flow while acquiring the equipment needed to scale your operations

- Time Wasted Managing Cash Flow

Constant juggling of expenses limits focus on core business activities

- Retain Working Capital for Reinvestment

Keep your cash reserves free for inventory, payroll, and unexpected opportunities

- Old Equipment Hurting Competitiveness

Outdated machinery increases downtime and reduces productivity

- Lease New Equipment and Stay Competitive

Access the latest technology without the burden of large capital expenditures

Expand Growth Opportunities with Available Cash

Expand your business when the timing is right without depleting your cash flow.

Purchase new or used equipment with loan/lease approvals valid from 90 days of approval.

Less Worry About Cash Flow

Stop the constant worry regarding cash on hand and focus on core business projects.

Acquire the equipment you need and distribute heavy equipment costs over time.

Improve Productivity While Staying Competitive

Keep pace with technology quickly and easily to do your best work.

Increase your purchasing power and improve your sales volume.

Mitigate your interest rate risk with stable fixed rates.

Manage Seasonal Business Trends

Create a customized loan or lease program to align payment schedules with your business revenue cycle.

Select the term, structure, or payment options to spread your payments out over time.

Take Advantage of Tax Deductions

Deduct the purchase price of qualifying equipment the year you buy it.

Satisfy accounting needs to reduce tax liability.

Maximize Profitability with Limited Budgets

Earn revenue today with new equipment as you pay over time with a fixed monthly payment.

Bundle your equipment, delivery, support and other services in one fixed monthly payment.

Business Financing Built Around You, Backed by Experts, and Delivered With Respect

Expert Advice

With years of real-world experience, we understand the priorities of business owners, CFOs, controllers, and purchasing leaders who manage critical equipment investments. From construction and paving to demolition and more, we offer market expertise that helps guide your financing decisions with confidence.

A True Financing Partner

When you call, we answer. We work directly with company leaders to deliver fast, flexible financing solutions that fit business objectives and timelines. Our goal is to build lasting relationships based on trust, responsiveness, and a clear understanding of your operational needs.

Transparency You Can Count On

We provide clear, straightforward loan and lease details, ensuring CFOs and financial decision- makers have full visibility into terms, payments, and total cost of ownership — no surprises, no hidden fees.

Tailored Financing Solutions

Every business is unique. We collaborate with business owners and financial teams to structure loan and lease programs that align with cash flow, budgeting cycles, tax planning, and long-term growth strategies.

Fast, Simple Approvals

We understand that timing matters. Our streamlined online application process allows you to move quickly and secure funding when opportunities arise — whether you’re replacing critical equipment or expanding your fleet.

Respectful, Honest Service

We treat our customers the way we would want to be treated: with integrity, open communication, and respect for the financial decisions you’re making on behalf of your business.

Simple Application Process

Easy online application with quick response times

No Equipment Restrictions

Finance virtually any equipment type for your business

Flexible Payment Options

Structured to match your business’s cash flow

We Make Equipment Financing Easy

Don’t let the process keep you from moving forward. Simply complete the online application form and submit it via our secure server. Then, one of our team members will contact you to share finance options and determine which is best for your business. Once your application has been submitted, you can expect to hear back from us in 24 to 48 hours.

1. Apply

Complete our simple online application in minutes. No paperwork, no hassle.

2. Review

Our team reviews your application and provides a decision within 24 hours.

3. Approval

Get approved and receive funding fast. Start growing your business today.

Financing Terms That Work for Your Business

We’re not just another equipment lender – we’re a strategic partner dedicated to your business growth.

Flexible Structures

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aliquam dignissim

Fast, Hassle-Free Funding

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aliquam dignissim

Transparent, Competitive Terms

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aliquam dignissim

Built-In Flexibility

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aliquam dignissim

Our Fast and Easy Application Process

We aim to make your finance application both fast and easy while providing you with the best terms possible.

Almost any type of heavy equipment can be financed, so your business operations can run smoothly and you can stay competitive.

Most applications are processed within a day or less.

Section 179 Deduction

Bigger, Better, and Ready for Your Business

The Section 179 Deduction has long been a valuable tax incentive for businesses, allowing for tax deductions up to the full purchase price of qualifying equipment—such as heavy machinery, commercial vehicles, and business-use technology—in the same year it’s placed in service, rather than spreading deductions over many years. Traditionally, this benefit was capped at just over $1 million annually, with limits that phased out for larger investments.

With the passage of the One Big Beautiful Bill Act in July 2025, Section 179 has been significantly expanded.

The deduction limit has more than doubled to $2.5 million, with the phase-out threshold now starting at $4 million in total annual equipment purchases.

Even more, businesses can now pair Section 179 with permanent 100% Bonus Depreciation —deducting additional qualifying costs above the Section 179 limit in the same year. These changes mean companies of all sizes can write off more equipment purchases immediately, improving cash flow and accelerating return on investment.

For complete details on how to make the most of Section 179 Deduction and the new 100% permanent Bonus Depreciation, please click the link below.