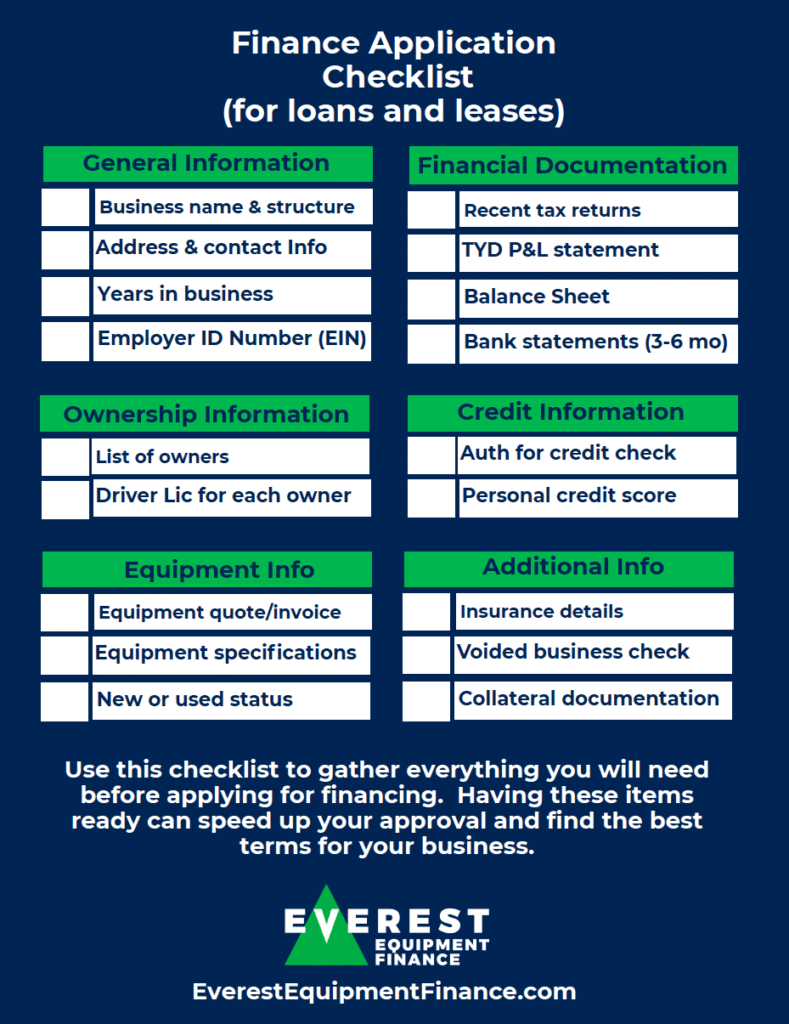

Credit Application Helpful Tips

Applying for heavy equipment financing is easier when you know what to expect. Use our Finance Application Checklist to get organized, save time, and keep your business moving forward.

✓ General Business Information

- Legal Business Name and Structure (Corporation, LLC, Sole Proprietorship, etc.)

- Business Address and Contact Information

- Years in Business (or startup details, if new)

- Employer Identification Number (EIN)

✓ Ownership Information

- List of Owners/Principals (with percentage ownership)

- Personal Identification (driver’s license or government-issued ID for each owner)

✓ Financial Documentation

- Most Recent Business Tax Returns (2 years, if available)

- Year-to-Date Profit & Loss Statement

- Balance Sheet

- Bank Statements (typically 3–6 months)

✓ Equipment Details

- Equipment Quote or Invoice (from dealer, auction, or private seller)

- Equipment Specifications (make, model, year, serial number if available)

- New or Used Status (and estimated hours/mileage if used)

✓ Credit Information

- Authorization for Credit Check (for business and owners)

- Personal Credit Score -for owners/guarantors (optional)

(Other)

- Insurance Details (existing policies or proof of coverage)

- Voided Business Check (for setting up automatic payments)

- Any Additional Collateral Documentation (if offering additional assets beyond the financed equipment)